- #PERSONAL FINANCE MANAGEMENT SOFTWARE FOR MAC FOR MAC#

- #PERSONAL FINANCE MANAGEMENT SOFTWARE FOR MAC WINDOWS#

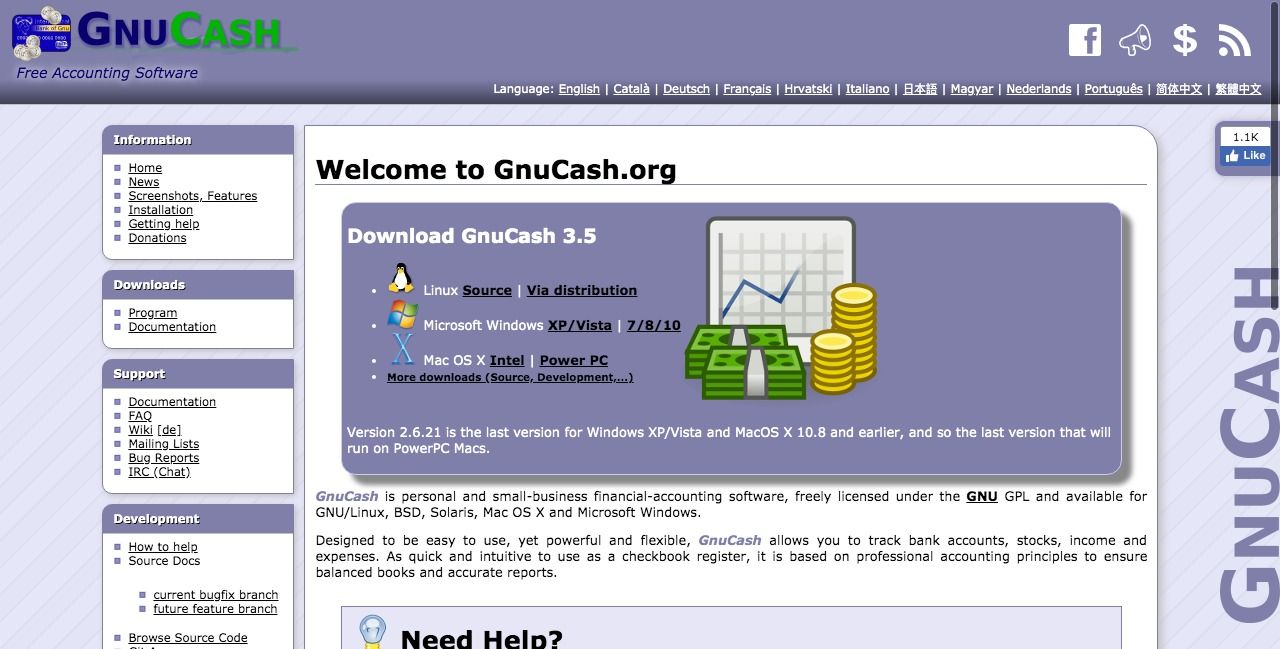

The good news is that nowadays there’s some great personal finance software for Mac that not only do a better job, they don’t require a monthly or annual subscription to use.

#PERSONAL FINANCE MANAGEMENT SOFTWARE FOR MAC WINDOWS#

The Mac version of Quicken has lagged behind the Windows version for years and even though Quicken 2019 For Mac was an improvement, the decision to make Quicken subscription only was the final straw for many faithful users. I found the budgeting tools to be excellent and, if you choose to use the envelope method, simple, when necessary, to pull money from one envelope so you can put it another.If you’ve finally had it with Quicken, we’ve taken a closer look at the best personal finance software for Mac of 2020 that make excellent alternatives to Quicken for Mac. iBank 5’s budgeting tool walks you through a brief questionnaire about scheduled and unscheduled transactions, how much income you expect to see each month and where you expect to spend your money.

The app’s budgeting tools offer both the traditional budgeting method of making “guesstimates” of how much you hope to spend each month and comparing your actual estimate to that budgeted amount or the truly old-school method of envelope budgeting, which pre-allocates funds to specific budget categories from which you can then “draw” funds for payment in those categories. Once selected these accounts can be customized to include specific accounts and categories. iBank 5 provides 10 starting points for reports, including Portfolio Summary, Category Detail, and Forecast reports. The app’s existing reports can be customized to suit your specific needs or you can create your own reports by choosing the Add New Report option from the Tools menu. The app’s basic offering include income and expense reports for the last month, last year, and current year as well as a net worth report. IBank 5 ships with several standard reports each of which gives a graphical overview of where you’ve spent your money. They’re just a kitschy addition to the app. These images can be customized to your liking, but the reality is that they offer little in the way of real value. So a grocery purchase has a small grocery basket next to it and a gasoline purchase has an image of a fuel dispenser next to it. Each transaction that appears in the list and for which you’ve supplied a category displays a small image representing the type of transaction you’re looking at. Transactions appear in a ledger to the right of the Library list. So, for example, if you share an account with someone but don’t want the money in that account to be included in your total net worth, you can easily exclude it. You have the option of selecting the accounts that are included in this summary. If you prefer an uncluttered look, any of the items appearing in the Library list can be hidden or revealed with the click of a button.Ī summary displaying how much money you have and how much you owe appears at the bottom of the list.

Items within iBank 5’s groupings can be dragged and reorganized in a way that makes sense to you. A Library list at the left of the app’s main window shows a list of your accounts, provides a basic set of reports, and tools for creating budgets. IBank 5 organizes your banking data in a way that makes it easy for you to quickly assess your current balances. If the default set of categories the app provides don’t suit your needs or are not as expansive as you need them to be, the Categories tool appearing in iBank’s library list lets you make quick work of adding, removing or updating categories. Fortunately iBank is a pretty quick study, capable of matching future transactions from the same vendors to the categories you originally mapped them to. Once your data is imported you do have to go about the business of matching your transaction data to expense categories. IBank 5 offers quick and comprehensive access to all your financial information.

0 kommentar(er)

0 kommentar(er)